Maison suisse experte du négoce de métaux précieux depuis 1895, Gold Service conseille et accompagne ses clients dans l’achat et la vente d’or, de façon responsable, au service de l’économie circulaire.

Nous intervenons lors de moments de vie souvent porteurs d’émotion et mettons à votre service notre expertise séculaire en alliant le meilleur du conseil et de l’efficacité.

Nos engagements : expertise, simplicité et immédiateté.

Notre objectif : votre satisfaction.

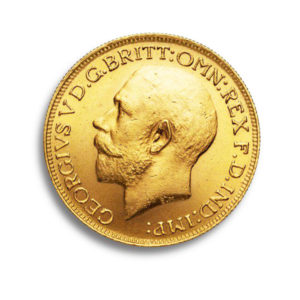

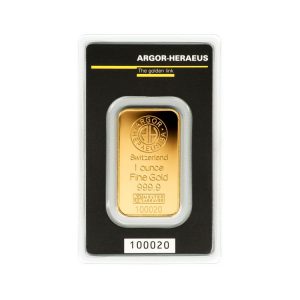

EN CE MOMENT

Nos valeurs

Responsabilité, exigence et engagement : ce sont les valeurs de la Maison Gold Service, forte de 125 ans de savoir-faire dans le négoce de métaux précieux. Ces valeurs guident nos actions, celles de nos équipes, au quotidien, pour proposer à nos clients un accompagnement sur-mesure dans la vente de leurs bijoux ou pour investir au meilleur moment.

Nos partenaires

Nous travaillons avec des professionnels reconnus à l’international pour la vente et l’achat de métaux précieux. Fonderie, Mint, transporteurs ou bijoutiers, nos partenaires ont toute notre confiance pour satisfaire l’ensemble de nos clients. Pour vos achats d’or ou la vente d’or, faites confiance à Gold Service, Maison suisse à l’expertise séculaire.